How do we work with you?

We will have a collaborative, enduring partnership with you. You’re not a ‘source of revenue’, but a partner in a long-term, intergenerational, personalised relationship of mutual trust and integrity. We look to bring a sense of honesty, authenticity, and continuous effort to our client relationships.

Our objective is very simple – to help you to preserve and enhance your existing wealth, not only for this generation, but for those to come. Each client has different objectives, aspirations, and issues.

All the while accomplishing that in a risk-appropriate way that gives you peace of mind.

What is our approach to wealth management?

What is our approach?

How do we understand your context?

By going through a rigorous process to understand your circumstances and situation. We then identify and refine your goals and objectives, whilst giving in-depth consideration to the risks you’re exposed to. We then work with Caliber Investment, our investment partner, to develop an investment solution that works for you. One that aligns and integrates advice and planning into an holistic approach.

Successful wealth management consists of 3 core elements. Planning and Professional Advice, which then will be matched with a rigorous, personalised and Aligned Investment Solution.

Planning details how you intend to accomplish your life objectives – from lifestyle considerations through to intergenerational wealth aspirations.

Private wealth clients will often have had significant amounts of specialist professional legal, accounting, tax and business advice as they accumulate wealth. Our objective is to work closely with your existing advisors to then determine how to combine planning and professional advice with an aligned investment solution that produces an effective wealth management approach.

You may have only undertaken a limited amount of planning and professional advice. We work with you and your existing advisors to review, update and conclude these processes where necessary.

Risk matters... a great deal.

No one can predict or control investment returns, but risk can be managed and mitigated. So our core focus in building a tightly aligned investment solution is to ensure that you understand the risks you’re exposed to. This risk “profile” is then translated into an investment solution that meets your objectives. It’s all about ensuring you are comfortable with the degree of risk you need to take to maximise the probability of meeting your objectives.

Our solutions are usually multi-asset, predominantly global in nature, and fundamentally built around sustainable investment/ESG principles. Deep liquidity and portfolio construction that meet your cash flow requirements are also hallmarks of our approach.

Using globally researched investment managers, along with direct asset exposures - adds breadth and depth to our client solutions. This approach, along with inclusion of managed alternatives such as non-correlated risk diversifiers and the use of currency as a separate asset class, allows us to profoundly diversify portfolios.

The final element of our approach is that of client service and ongoing monitoring and review. Change is the one constant in life and as you and your family’s lives and context change and evolve, then so do your objectives. Continuous review and revision, planning, advice and aligning investment solutions to meet that change is essential. We also look to provide a personalised client service experience that not only meets but exceeds your expectations.

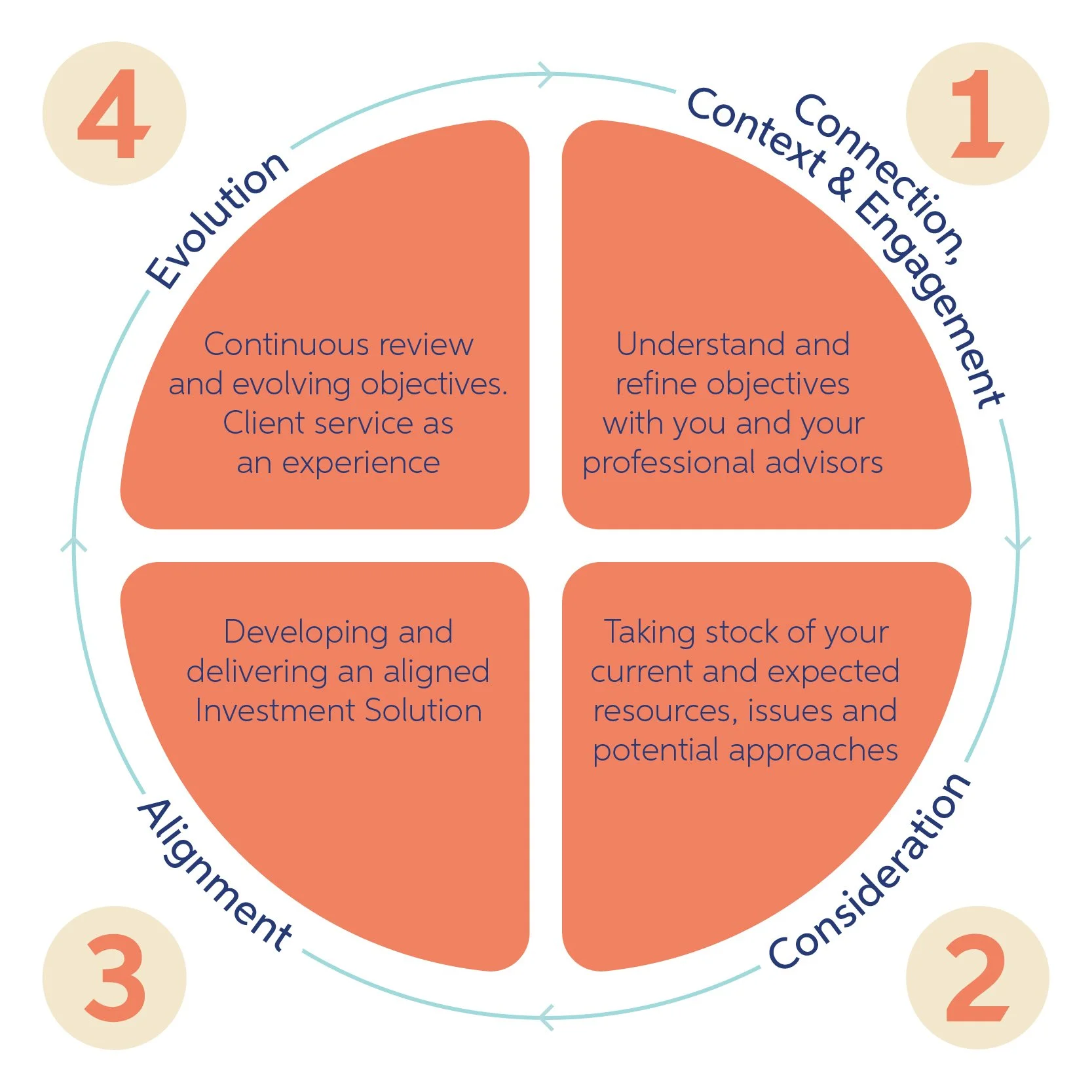

Our Wealth Management Process

1. Connection & Engagement

Our process starts with establishing a connection and engagement with you and your professional advisors. We look to reach a deep and comprehensive understanding of your current situation, and what your objectives are both for yourself and future generations.

2. Consideration

We take stock of your current and expected resources, the constraints/liabilities and challenges you face now and on an intergenerational basis looking forward. Determining attitudes towards risk capacity and risk tolerance is an important part of this step.

3. Alignment

We then work closely with our specialist investment partner, Caliber Investment, to develop a personalised portfolio solution that is aligned as closely as possible with your objectives. This allows us maximise the opportunity for you to meet your goals and objectives.

Implementing and administering this investment solution is an important part of this third step and we work with you and your advisors to ensure that this is done in the most efficient and effective way.

4. Evolution

Change is the one constant in life and as you and your family’s lives and context change and evolve, then so do your objectives. Continuous review and revision, planning, advice and aligning investment solutions to meet that change is essential.